Share

Equipment finance enables businesses to implement growth strategies through structured asset investment. Understanding finance options helps companies make informed decisions about equipment acquisition and operational expansion.

Equipment finance provides businesses with methods to acquire assets and improve operations without major capital expenditure. Strategic planning of equipment investments supports business development while maintaining financial flexibility for daily operations.

Equipment assessment and planning

A thorough equipment audit identifies investment priorities. This process reveals which assets need replacement, upgrading, or maintenance. The audit helps businesses understand where new equipment could increase efficiency, reduce costs, or open revenue opportunities.

Finance structure options

Different equipment finance structures suit varying business requirements. Lease agreements, hire purchase contracts, and chattel mortgages each present distinct advantages. Payment structures match business cash flow patterns, preserving working capital for core business activities.

Technology investment planning

New technology brings operational improvements across business functions. Advanced payment systems cut transaction times, while updated machinery reduces production delays. Finance arrangements let businesses implement technology improvements without budget constraints.

Business expansion support

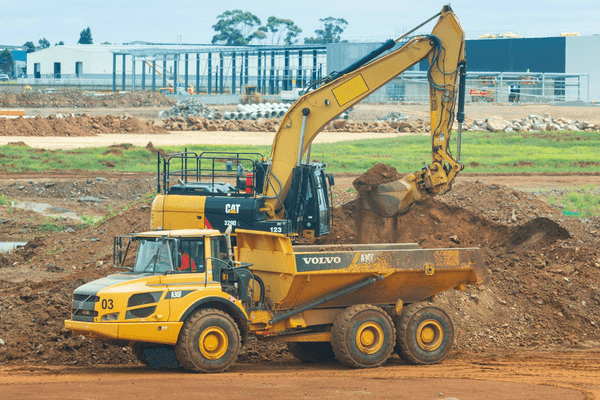

Equipment finance supports business growth plans through staged asset acquisition. Companies can expand their vehicle fleets, increase production capacity, or add seasonal equipment. Payment arrangements align with projected income growth from expanded operations.

Tax management approaches

Equipment purchases through finance arrangements create tax planning opportunities. Asset depreciation and finance costs may qualify as tax deductions. Strategic timing of equipment acquisition helps businesses maximise available tax benefits, including temporary tax incentive programs.

Further questions

What equipment residual values affect finance terms?

How does equipment location impact finance approval?

What maintenance provisions exist in equipment finance?

Can businesses bundle multiple equipment purchases?

What security requirements apply beyond the equipment?

This is general information only and is subject to change at any given time. Your complete financial situation will need to be assessed before acceptance of any proposal or product.