Share

Australian property market shows sustained 0.6% growth in July 2025. Analysis of regional trends, rental dynamics, supply constraints and outlook.

Australia’s property market delivered its sixth consecutive month of growth in July 2025, with dwelling values climbing 0.6% nationally. This sustained momentum reflects a market that has discovered its rhythm, supported by declining interest rate expectations, persistent housing supply shortages, and renewed buyer confidence across the nation.

The latest performance data reveals a property sector that has evolved beyond recent volatility into measured, sustainable expansion. For Australian consumers navigating today’s complex housing landscape, these trends offer crucial insights into current opportunities and emerging market dynamics that will shape property decisions for years ahead.

National property market maintains strong growth trajectory

July 2025 delivered another month of robust performance for Australian property markets, with the 0.6% national dwelling value increase perfectly matching growth rates from May and June. This remarkable consistency signals a market operating in sustainable growth mode rather than speculative excess.

Annual house price growth has surged to 5.9%, pushing the national median house price to $1,208,603. This milestone represents a fundamental shift in Australia’s property market dynamics, demonstrating how persistent demand pressures continue driving values higher despite affordability constraints.

Auction market strength provides compelling evidence of current conditions. Clearance rates have maintained their position above the critical 70% threshold for nine consecutive weeks, with July’s peak rate of 74.7% marking a 12-month high. These figures indicate intense buyer competition and unwavering confidence in market fundamentals.

Australia’s residential property wealth has stabilised at $11.5 trillion, representing one of the world’s most substantial property markets. This enormous asset base underpins national economic stability and reinforces property’s central role in Australian household wealth creation strategies.

| Metric | Value | Change |

|---|---|---|

| Monthly dwelling value growth | 0.6% | Consistent with May-June |

| Annual house price growth | 5.9% | Strong momentum |

| Median house price | $1,208,603 | New milestone |

| Auction clearance rate (peak) | 74.7% | 12-month high |

| Total property value | $11.5 trillion | Stable |

| New listings vs 5-year average | -19% | Supply constrained |

| Sales volumes vs average | +1.9% | Above normal demand |

The current expansion differs markedly from previous boom cycles. Rather than explosive increases driven by speculation, today’s growth reflects genuine supply-demand fundamentals, suggesting more durable long-term prospects for sustainable appreciation.

Regional performance reveals compelling market opportunities

Regional markets in July 2025 showcased Australia’s property diversity, with each capital responding to distinct economic drivers and local conditions that savvy consumers can leverage for strategic advantage.

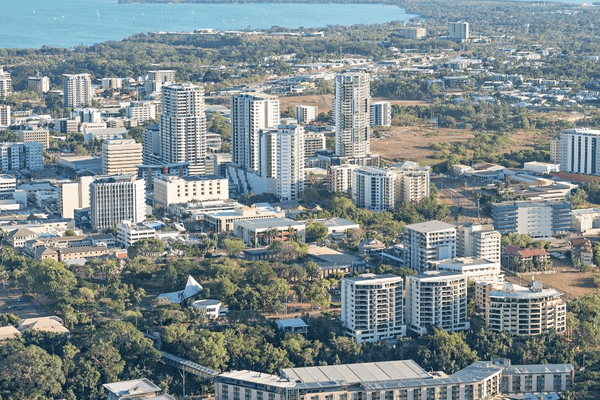

Darwin emerged as the undisputed growth champion with an exceptional 2.2% monthly surge, building on its remarkable 9.7% year-to-date performance. The Northern Territory capital’s transformation reflects major infrastructure investment and resource sector expansion that have fundamentally altered housing demand dynamics.

Perth sustained its impressive momentum with 0.9% monthly growth, representing the fastest expansion since September 2024. Western Australia’s mining prosperity and interstate migration flows have created demand pressures showing no immediate signs of weakening.

Brisbane and Adelaide each delivered solid 0.7% monthly gains, highlighting these markets’ enduring appeal to diverse buyer segments. Brisbane’s performance carries particular significance given its median dwelling price of $805,084 now surpasses Melbourne’s $796,952, marking a historic shift in traditional capital city hierarchies.

| Capital City | Monthly Growth | Annual Growth | Median Price | Market Position |

|---|---|---|---|---|

| Darwin | 2.2% | 9.7% | $520,000* | Growth leader |

| Perth | 0.9% | 15.2%* | $650,000* | Strong momentum |

| Brisbane | 0.7% | 7.3% | $805,084 | Surpassing Melbourne |

| Adelaide | 0.7% | 8.1%* | $741,142 | Consistent performer |

| Sydney | 0.6% | 1.8% | $1,706,971 | Premium stability |

| Melbourne | 0.4% | 0.8% | $796,952 | Recovery phase |

| Hobart | 0.1% | 1.9% | $680,000* | Moderate growth |

| Canberra | 0.5% | 0.5% | $850,000* | Subdued performance |

*Estimated figures based on available data

Sydney, despite premium positioning, matched the national average with 0.6% growth. The harbour city’s median dwelling price of $1,706,971 remains Australia’s highest, though affordability pressures are moderating growth compared to other capitals.

Melbourne recorded the most conservative increase at 0.4%, reflecting ongoing recovery from previous adjustments. However, emerging indicators suggest the Victorian capital is gaining momentum as economic fundamentals strengthen.

This regional performance diversity creates significant opportunities for informed property consumers. Understanding local drivers enables strategic decision-making that capitalises on specific market conditions rather than assuming uniform national trends.

Darwin leads exceptional growth performance

Darwin’s outstanding 2.2% monthly increase reflects the Northern Territory’s economic transformation. Major infrastructure projects, including port expansions and defence facilities, have created substantial employment growth and housing demand. The territory’s strategic location for Asian trade routes and resource export capabilities continue attracting significant investment, supporting sustained property market momentum.

Perth benefits from mining sector strength

Western Australia’s property market strength stems from the state’s dominant position in global mining exports. Iron ore and lithium demand, particularly from Asian markets, has driven employment growth and interstate migration to Perth. The combination of relatively affordable housing compared to eastern capitals and strong economic fundamentals positions Perth for continued growth.

Rental markets operating under severe supply stress

Australia’s rental sector continues functioning under acute supply constraints, with national vacancy rates holding near historic lows despite a marginal increase from 1.2% to 1.3% in June 2025. This modest improvement masks persistent rental stress across most metropolitan areas.

Current rental market dynamics strongly favour landlords, with median asking rents reaching $868 weekly for houses and $644 for units. Annual rental escalation of 4.8% for houses and 3.7% for units reflects the ongoing accommodation shortage plaguing major cities.

Critical shortage conditions persist in multiple markets. Darwin and Hobart continue experiencing severely constrained availability with vacancy rates of just 0.5% and 0.6% respectively. These levels indicate rental markets operating under extreme stress with limited short-term relief prospects.

| Capital City | Vacancy Rate | Median House Rent | Median Unit Rent | Gross Yield |

|---|---|---|---|---|

| Darwin | 0.5% | $750/week* | $580/week* | 6.4% |

| Hobart | 0.6% | $650/week* | $480/week* | 4.2%* |

| Adelaide | 0.7% | $580/week* | $420/week* | 3.8%* |

| Perth | 0.8% | $620/week* | $450/week* | 4.1%* |

| Brisbane | 1.1%* | $658/week | $480/week* | 3.9%* |

| Melbourne | 1.8%* | $650/week* | $520/week* | 3.2%* |

| Sydney | 1.9%* | $837/week | $680/week* | 2.8%* |

| Canberra | 2.1% | $720/week* | $550/week* | 3.5%* |

| National Average | 1.3% | $868 | $644 | 3.68% |

*Estimated figures based on available data

Rental yield analysis reveals evolving investment dynamics. National gross rental yields have softened to 3.68%, down from 3.71% in April, as capital growth has outpaced rental increases. Darwin continues offering the most attractive yields at 6.4%, combining relatively affordable purchase prices with robust rental demand.

The rental sector’s tight conditions have triggered reaccelerating growth trends. On a seasonally adjusted basis, national rents increased 1.1% over the three months ending July, up significantly from recent lows of 0.5% through September 2024.

These conditions create compelling opportunities for property investors seeking reliable income streams, particularly in markets showing both capital growth potential and sustainable rental yields.

Housing supply shortage drives sustained market support

Australia’s housing supply crisis remains the most significant factor supporting property market performance, with new dwelling approvals continuing to fall dramatically short of demographic requirements. The year to May 2025 recorded only 182,900 dwelling approvals, representing a critical shortfall of 57,100 dwellings against the required 240,000 annual target.

The federal government’s ambitious objective of delivering 1.2 million new homes over five years faces mounting challenges. Current projections indicate the target will fall short by between 262,000 and 375,000 dwellings by 2029, highlighting the severe scale of Australia’s housing supply emergency.

Construction industry constraints continue limiting supply responses. Severe skilled worker shortages, elevated material costs, and complex planning processes have combined to restrict industry capacity. These structural impediments are projected to persist through 2025 and beyond, maintaining upward pressure on property values.

| Measure | Target/Requirement | Current Forecast | Shortfall |

|---|---|---|---|

| Annual dwelling approvals | 240,000 | 182,900 | -57,100 |

| Five-year housing target | 1,200,000 | 825,000-938,000 | -262,000 to -375,000 |

| Apartment/medium density annual target | 95,000* | 57,000 | -38,000 |

| Construction completions 2024 | 223,000 | 177,000 | -46,000 |

| Population growth accommodation requirement | 175,000 households/year | Current supply insufficient | Ongoing deficit |

*Estimated target based on historical requirements

Market dynamics further illustrate supply constraints. New property listings track approximately 19% below five-year averages, while sales volumes remain 1.9% above typical levels. This fundamental imbalance sustains upward value pressure and supports robust auction clearance rates.

The supply shortage proves particularly acute in apartment and medium-density housing sectors. Net additions of apartments and townhouses are projected at around 57,000 annually, approximately 40% below late 2010s levels when higher-density construction helped address previous shortages.

These supply constraints create a structural foundation supporting property values across multiple time horizons, offering confidence to both owner-occupiers and investors regarding medium-term market stability.

Construction industry faces multiple headwinds

The construction sector continues grappling with severe skilled labour shortages, exacerbated by reduced migration during pandemic periods and competition from major infrastructure projects. Material cost inflation, while stabilising, remains elevated compared to historical levels. These factors combine with complex planning approval processes to constrain supply responses despite strong demand.

Market outlook indicates sustained growth with measured expectations

Forward-looking analysis suggests Australia’s property market will maintain its growth trajectory through 2025, though at more sustainable rates than recent boom periods. Major financial institutions have upgraded forecasts, with ANZ Bank now predicting capital city price rises of 5.0% in 2025 and 5.8% in 2026.

KPMG analysis projects more conservative expansion, forecasting house prices to rise 3.3% and unit prices 4.6% during 2025. These projections balance continued supply constraints against affordability pressures and economic uncertainty factors.

Interest rate environment expectations significantly influence market outlook. Rate cuts anticipated in the second half of 2025 are expected to provide substantial support for buyer sentiment and transaction activity. However, monetary policy timing and extent remain subject to broader economic developments.

| Forecasting Body | 2025 House Growth | 2025 Unit Growth | 2026 Projection | Key Assumptions |

|---|---|---|---|---|

| ANZ Bank | 5.0% | Not specified | 5.8% overall | Rate cuts, supply constraints |

| KPMG | 3.3% | 4.6% | Not specified | Moderate conditions |

| PropTrack | 1-4% national | Not specified | Not specified | Interest rate relief mid-2025 |

| Industry Consensus | 3-6% range | 4-7% range | 4-8% range | Supply shortage continuation |

Housing affordability continues presenting the most significant growth headwind. New mortgage holders typically allocate 50% of household income to housing costs, while renters dedicate 33% of income to accommodation expenses. These proportions approach historical peaks and may constrain future demand expansion.

Demographic trends support continued housing demand over medium-term horizons. Australia’s population is forecast to exceed 30 million by 2030, requiring substantial additional housing stock. However, demand composition is shifting, with lone person households expected to be the fastest-growing segment.

Investment market dynamics suggest sustained activity from both domestic and international buyers. However, regulatory changes and tax policy considerations may influence investment demand patterns moving forward, creating opportunities for well-informed market participants.

The property market outlook for 2025 reflects a mature cycle characterised by sustainable growth rather than speculative excess. This environment may favour well-located properties in markets with strong underlying fundamentals over speculative investments in fringe locations.

Strategic insights for informed property decisions

Australia’s property market analysis for July 2025 reveals a sector demonstrating exceptional resilience amid complex economic conditions. The sixth consecutive month of 0.6% national growth, combined with robust auction performance and persistent supply constraints, indicates a market achieving sustainable momentum rather than speculative excess.

Regional performance variations highlight the critical importance of local market knowledge. Darwin, Perth, Brisbane and Adelaide lead growth trends while Sydney and Melbourne show more measured increases. These patterns reflect diverse economic drivers and suggest property market success increasingly depends on understanding specific regional dynamics rather than assuming uniform national trends.

The rental market’s persistent supply shortage, evidenced by near-record low vacancy rates and continued rent growth, underpins property investment fundamentals. However, declining yields in premium markets suggest investors must carefully assess both capital growth and income return prospects when making strategic decisions.

Housing supply constraints will continue supporting property values throughout the medium term, though affordability challenges may moderate growth rates. The substantial shortfall against government housing targets indicates supply-demand imbalances will persist, maintaining structural support for well-located property investments.

For Australian consumers, the current market environment presents opportunities for well-researched property decisions, though careful analysis of local conditions, financial capacity, and long-term objectives remains paramount. The property market’s evolution toward sustainable growth patterns favours quality over speculation, fundamentals over hype, and strategic thinking over emotional decision-making.

Further questions

What drove Australia's property market growth in July 2025

Which Australian capital cities showed the strongest property price growth in 2025

How tight are rental markets across Australian capital cities in 2025

What is causing Australia's housing supply shortage and when will it improve

What are the property market forecasts for Australia in 2025 and 2026

This is general information only and is subject to change at any given time. Your complete financial situation will need to be assessed before acceptance of any proposal or product.