Commercial / Business finance

Business car loans

Get the right business vehicle finance for your needs

Need a company car, ute, van, or truck? At Attain Loans, we can help you secure the right business car loan without paying the full upfront cost. Our expert team will find you competitive rates and flexible terms suited to your business needs.

Book a consultationHow business car loan applications work

At Attain Loans, we can find the right vehicle finance solution for your business. Our service typically comes at no charge as we're paid by the lender, and these payments don't influence our recommendations.

Business car loans

A business car loan, also known as a commercial vehicle loan or chattel mortgage, is a financing option that allows businesses to purchase vehicles without paying the full cost upfront. Business car loans are more complex than personal car loans, with different assessment criteria and lending requirements. This type of loan is specifically designed for business owners, self-employed individuals, or those who require a vehicle primarily for business purposes, at least 50% of the time.

How Business Car Loans Work

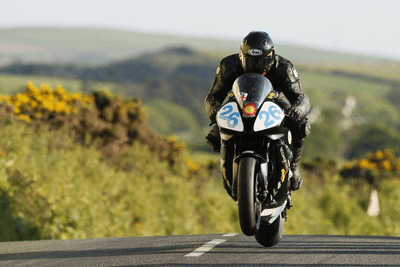

- You borrow a lump sum to purchase a business vehicle, which can include cars, utes, vans, or trucks.

- The loan is repaid in instalments with interest over a fixed term, typically ranging from 1 to 7 years.

- The vehicle itself serves as security for the loan, allowing for lower interest rates compared to unsecured loans.

- Unlike some leasing options, with a chattel mortgage, your business owns the vehicle from the outset.

Types of Business Car Loans

- Chattel mortgage

The most common type, where the business owns the vehicle but the lender holds security over it. - Hire purchase

The business hires the vehicle with the option to purchase at the end of the term. - Finance lease

The lender owns the vehicle and leases it to the business, with the option to transfer ownership at the end of the lease.

Questions about Business car loans

Get in touch and we will help you with any questions you have about business car loans and advise on the best approach for your business.

Let us help with your questionsHow much can I borrow for a business car loan?

What interest rates are available for business car loans?

Do I need a deposit for a business car loan?

What types of business car loans are available?

How long does it take to get approved for a business car loan?

Can I get a business car loan if I'm a sole trader?

What documentation do I need for a business car loan application?

- Business financial statements (last 2 years)

- Tax returns (business and personal)

- Bank statements

- ABN/ACN details

- Proof of identity

- Vehicle details and quotes

Can I claim tax deductions on my business car loan?

What happens if I want to pay off my business car loan early?

Can I refinance my existing business car loan?

Your full financial situation and requirements need to be considered prior to any offer and acceptance of a loan product. The information contained in this website is of a general nature and does not take in to account your personal needs and requirements.

Latest car and vehicle finance articles

Why choose Attain Loans for your business car loan?

Our expertise in business vehicle finance means we can evaluate loan types and lender requirements on your behalf. We will get you not just a great rate, but the right loan structure to match your business goals and cash flow needs.

We're family

We are a small family owned, Altona based business that understands your needs at different stages of your life.

We listen

Identifying your goals and finding services and products that meet your needs is our number one job, and we love it!

22 years industry experience

We know the intricacies of the mortgage market and can tailor mortgage solutions for your individual needs.

We have access to the very best lenders

Over 70 of them, including the majors. We're accredited, which means we are fully trained and know all the best options available for you.

Ongoing support

Even when we've found you a great deal we undertake regular reviews to see if we can find you something even better.

We're awesome!

We have an honest, client focused business model and we aim to create long lasting relationships built on trust and respect.

Our happy customers

Financial security gives you choices. It lets you move home, learn new things, travel, or start and grow a business. When you're financially secure, you can focus on what's important. Your family, health, and personal growth.