Share

Explore asset finance benefits for Australian manufacturers: improved cash flow, enhanced productivity, reduced risk, increased capital access, and tailored financing solutions

Asset finance is a powerful tool that allows manufacturing businesses to acquire essential equipment and technology without large upfront costs. Here are five key benefits of asset finance for manufacturers in Australia:

Improved cash flow management

Asset finance enables manufacturers to preserve their working capital by spreading the cost of equipment over time. Instead of making a large lump-sum payment, businesses can make manageable monthly instalments. This approach frees up cash for other critical areas such as:

- Marketing

- Research and development

- Expansion and hiring

- Day-to-day operational expenses

By maintaining a healthier cash flow, manufacturers can better manage their finances and seize growth opportunities without compromising their liquidity. Before taking on asset finance, consider debt consolidation to optimise existing financial commitments.

Enhanced productivity and efficiency

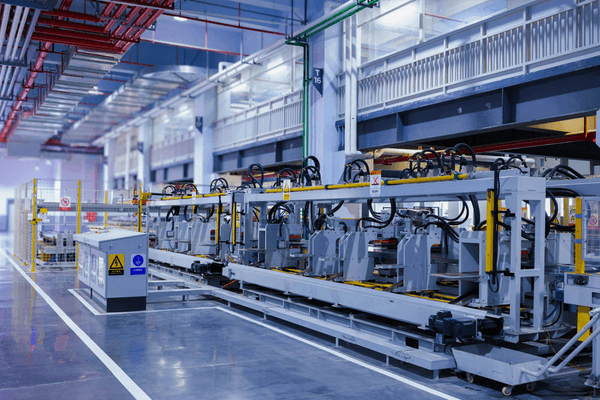

Access to the latest equipment and technology is crucial for manufacturers to stay competitive. Asset finance makes it possible to acquire state-of-the-art machinery that can significantly boost productivity. This can lead to:

- Increased production output

- Improved product quality

- Reduced waste and operational costs

- Faster turnaround times

By leveraging asset finance, manufacturers can continually upgrade their equipment, ensuring they remain at the forefront of technological advancements in their industry.

Reduced business risk

Investing in new equipment always carries some level of risk. Asset finance helps mitigate these risks in several ways:

- Protection against obsolescence: Regular upgrades keep your equipment current

- Flexible terms: Align repayments with your business cycles and cash flow

- Potential tax benefits: Interest payments may be tax-deductible (consult your accountant)

- Preserved credit lines: Keep other credit facilities available for unexpected needs

This risk reduction allows manufacturers to focus on their core business activities with greater confidence and financial stability.

Increased access to capital

Traditional bank loans can be challenging to secure, especially for smaller or newer manufacturing businesses. Asset finance provides an alternative route to capital, often with less stringent requirements. This increased access to funds can be crucial for:

- Startups looking to establish operations

- Small to medium-sized manufacturers aiming to scale up

- Businesses with limited credit history or collateral. For established manufacturers considering property expansion, large format retail investments offer compelling commercial property opportunities.

Asset finance can bridge the gap between a manufacturer’s ambitions and their current financial capabilities, enabling growth that might otherwise be out of reach.

Tailored financing solutions

One of the most significant advantages of asset finance is its flexibility. Lenders can create customised financing packages that align with a manufacturer’s specific needs and circumstances. This customisation can include:

- Varied loan terms to match equipment lifespan or cash flow patterns

- Seasonal payment structures for businesses with cyclical demand

- Balloon payment options to reduce regular instalments

- Inclusion of soft costs like installation or training in the finance package

This flexibility ensures that the financing solution complements the manufacturer’s business model and strategic objectives, rather than forcing the business to adapt to rigid loan terms.

Further questions

What is asset finance for manufacturing businesses in Australia?

How does asset finance improve cash flow for Australian manufacturers?

What are the productivity benefits of using asset finance in Australian manufacturing?

How does asset finance reduce business risk for manufacturers in Australia?

What types of customised financing solutions are available through asset finance for Australian manufacturers?

This is general information only and is subject to change at any given time. Your complete financial situation will need to be assessed before acceptance of any proposal or product.